Getting My Financial Advisor Ratings To Work

Wiki Article

Financial Advisor License - The Facts

Table of ContentsRumored Buzz on Financial AdvisorHow Financial Advisor Certifications can Save You Time, Stress, and Money.Unknown Facts About Financial Advisor RatingsFacts About Financial Advisor Fees Revealed

There are numerous sorts of economic advisors out there, each with varying qualifications, specialties, and levels of liability. As well as when you get on the hunt for an expert suited to your requirements, it's not uncommon to ask, "Exactly how do I recognize which economic expert is best for me?" The response begins with a sincere bookkeeping of your needs as well as a little bit of research.That's why it's necessary to research potential consultants and also comprehend their credentials prior to you hand over your cash. Sorts Of Financial Advisors to Consider Relying on your economic demands, you may choose a generalised or specialized economic expert. Recognizing your alternatives is the very first step. As you begin to dive into the world of seeking a financial advisor that fits your demands, you will likely exist with lots of titles leaving you asking yourself if you are contacting the ideal individual.

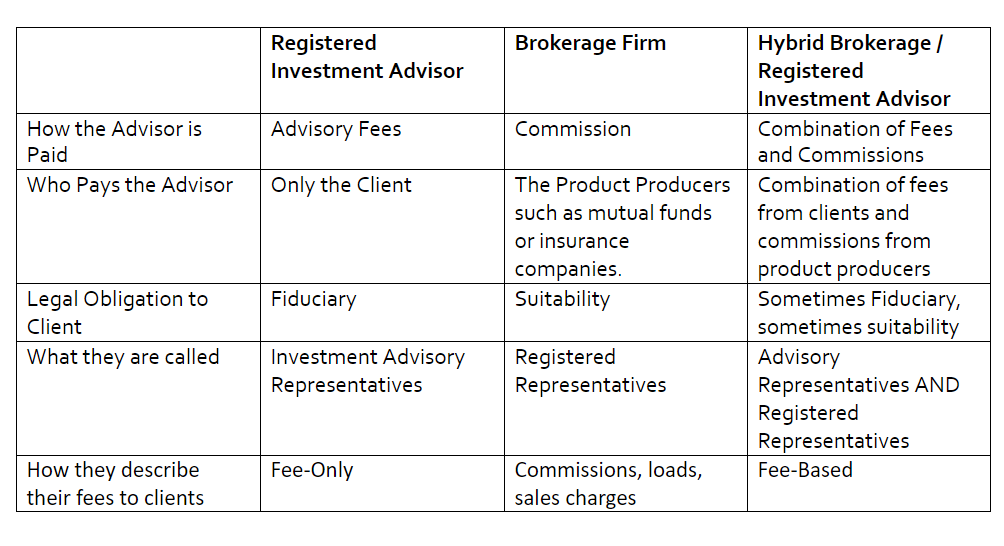

It is essential to note that some monetary advisors additionally have broker licenses (significance they can sell safeties), yet they are not only brokers. On the very same note, brokers are not all accredited equally as well as are not financial consultants. This is simply among the lots of reasons it is best to begin with a certified monetary coordinator who can advise you on your investments and retired life.

The Basic Principles Of Financial Advisor Job Description

Unlike investment advisors, brokers are not paid directly by customers, rather, they make payments for trading stocks and bonds, as well as for selling mutual funds and other items.

A certified estate coordinator (AEP) is important link an advisor that specializes in estate planning. When you're looking for a monetary advisor, it's good to have a concept what you want aid with.

A lot like "economic consultant," "financial coordinator" is likewise a broad term. Someone with that title can also have other qualifications or specializeds. No matter your details needs as well as financial circumstance, one requirements you must strongly think about is whether a prospective advisor is a fiduciary. It may surprise you to find out that not all monetary consultants are called for to act in their clients' best passions.

Things about Financial Advisor Salary

To safeguard yourself from someone that is just trying to obtain more cash from you, it's a good suggestion to try to find a consultant who is registered as a fiduciary. A financial advisor that is registered as a fiduciary is needed, by legislation, to act in the most effective passions of a client.Fiduciaries can just suggest you to utilize such items if they assume it's really the most effective economic decision for you to do so. The United State Securities and also Exchange Compensation (SEC) regulates fiduciaries. Fiduciaries who fall short to act in a client's ideal passions can be hit with penalties and/or imprisonment of approximately ten years.

Nevertheless, that isn't since any individual can get them. Receiving either qualification needs somebody to go with a range of courses as well as tests, in addition to making a set quantity of hands-on experience. The outcome of the certification procedure is that CFPs and also Ch, FCs are fluent in subjects throughout the area of individual financing.

The fee might be 1. Fees typically reduce as AUM increases. The choice is a fee-based consultant.

website link

Not known Details About Financial Advisor Definition

A consultant's monitoring charge might or might not cover the costs connected with trading protections. Some advisors also charge an established charge per deal.

This is a solution where the advisor will bundle all account management expenses, including trading fees and also expense proportions, into one comprehensive fee. Due to the fact that this fee covers much more, it is usually greater than a fee that just consists of administration as well as omits points like trading costs. Wrap charges are appealing for their simplicity but also aren't worth the expense for everybody.

They also bill fees that are well listed below the consultant costs from standard, human experts. While a conventional advisor typically bills a charge between 1% and also 2% of AUM, the cost for a robo-advisor is usually 0. 5% or much less. The huge compromise with a robo-advisor is that you commonly don't have the capacity to speak with a human expert.

Report this wiki page